The ABC’s of the 1040! Individual Income Tax Planning: Part 1 Learning how to read your 1040

Tax season is coming. In a scant two months it will be here and for some, it will arrive bringing stress and confusion. As a tax preparer my goal is to minimize those feelings of confusion and anxiety in my clients by providing them clear and accurate information, fighting for their taxpayer rights, and lawfully minimizing their tax exposure. This post is to provide what I hope is accurate and helpful information to everyone, whether you’re a client or not.

As a taxpayer, the law states that you are personally responsible for everything on your tax return. This blog series will help you feel more confident as you read through the ABC’s of the 1040! This first part will provide you a brief overview of the 1040 itself. Subsequent posts will describe each of the “Schedules” associated with the 1040 which, depending on your situation, may or may not be necessary for your tax return

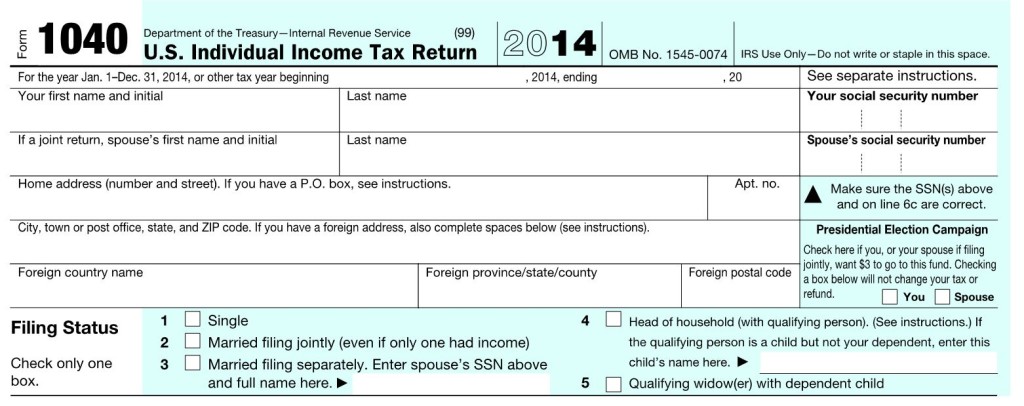

The 1040

The 1040 Individual Income Tax Return is two pages long. Yet the information contained tells the government quite a bit about your household size, income, and tax-related spending.

After your identifying information, the filing status is determined. Since the purpose of this blog series is to familiarize you with the 1040 and its associated schedules, I can’t go over the complex ramifications that this selection might have. I will say that this simple checkbox plays one of the greatest factors in the amount of tax that will be assessed. Each one of these boxes has a distinct definition that covers multiple scenarios and possibilities. Check with a tax advisor if you have any questions!

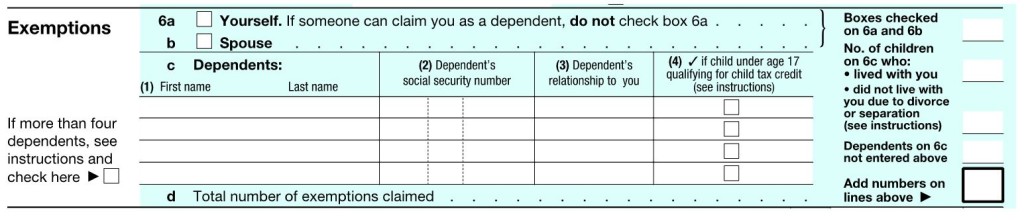

Exemptions

The number of exemptions determines the amount of income you deduct based on your household size. This will be used on page 2.

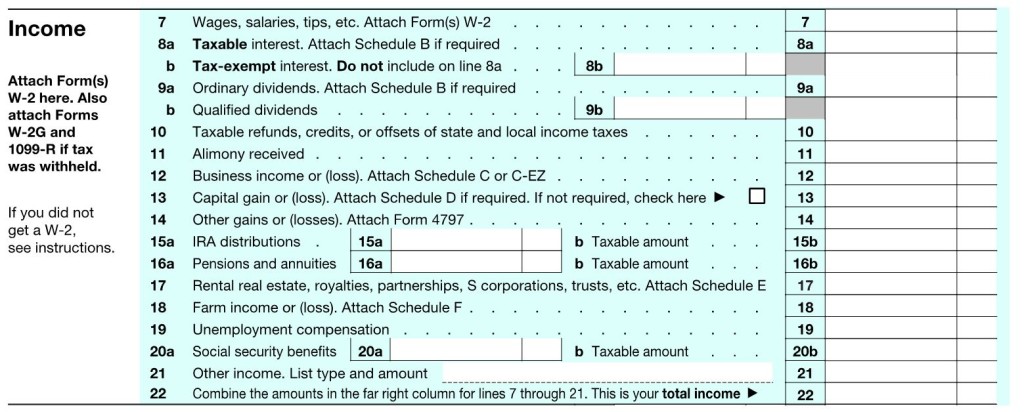

Income

The first section’s purpose is to report all your income, by income source. The source of income determines the type of income it is (i.e. ordinary income vs. passive income). As you can see, most of these lines derive their value from the related schedules, or what I’m referring to in this series, as the “ABC’s”. I will be covering each schedule in more depth in future blog posts so be sure to subscribe to my feed or my newsletter.

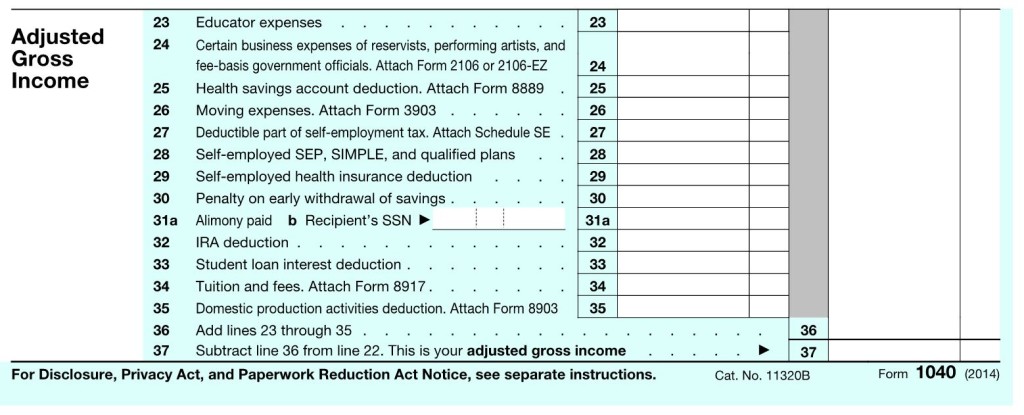

Adjusted Gross Income

There are a few legislative adjustments to income that directly reduce your taxable income before arriving at the Adjusted Gross Income (AGI). This number is very important and another essential value that determines quite a few of the tax calculations and assessments. Tax time is the only time of year, you want this number to be low! 🙂

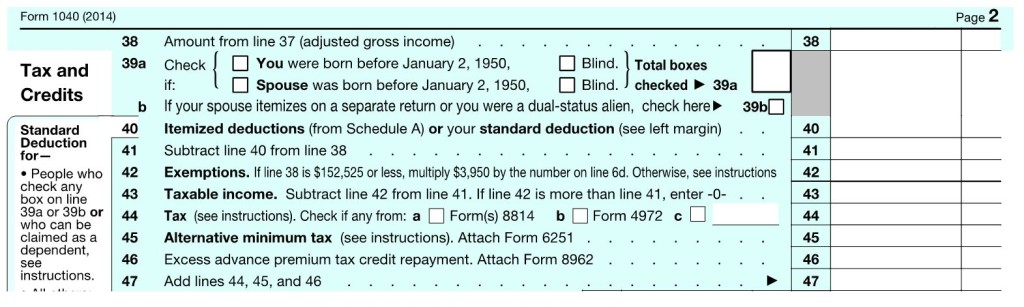

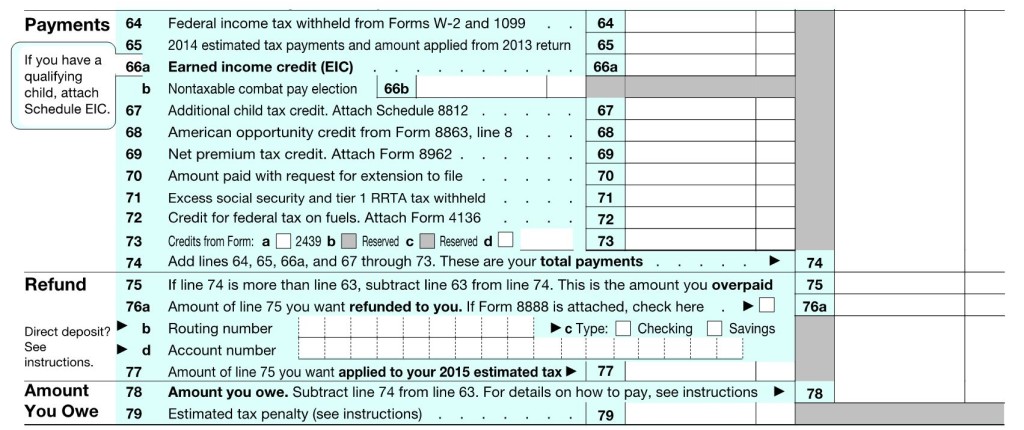

Tax and Credits

Starting with your AGI on page two, take deductions and exemptions to calculate your taxable income. Your taxable income is the number that determines your tax bracket (percent of income). You then arrive at your basic income tax. However, this is not your total tax yet! As you can see on lines 44 – 47 below, there are some taxes with different tax brackets, so those get added.

Although you’ve arrived at line 47, this is not your total tax yet either! Let’s talk credits. Credits reduce taxes (which is the amount you are assessed by the IRS) whereas adjustments, deductions and exemptions only reduce the taxable income. Almost always, credits are better than deductions. But, not all credits are created equal :). These first set of credits are non-refundable credits, meaning they can only reduce your tax to zero, and in most cases, will not carry forward to future tax years.

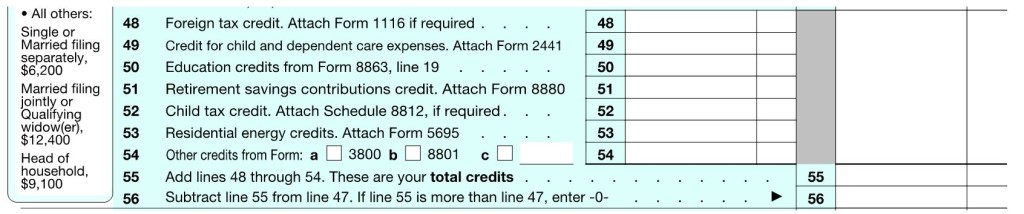

Other Taxes

There are some types of taxes that cannot be reduced through tax credits, so there is a special section just for those calculations and additions to finally arrive at your Total Tax.

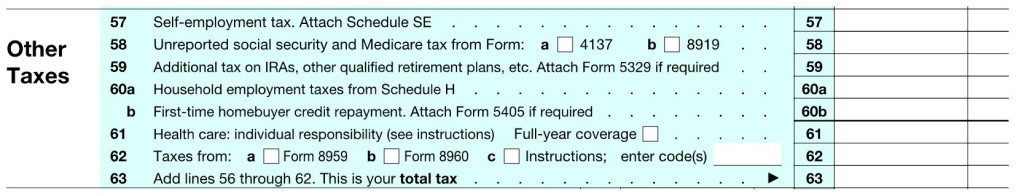

Payments and Credits

While Total Tax is the amount you owe the IRS for any given tax year, payments you have already made throughout the year and tax credits that you are able to claim can further reduce that number! This next section is called Payments, but the majority of entries relate to refundable tax credits. That means these credits can be fully taken, even if it results in a tax refund.

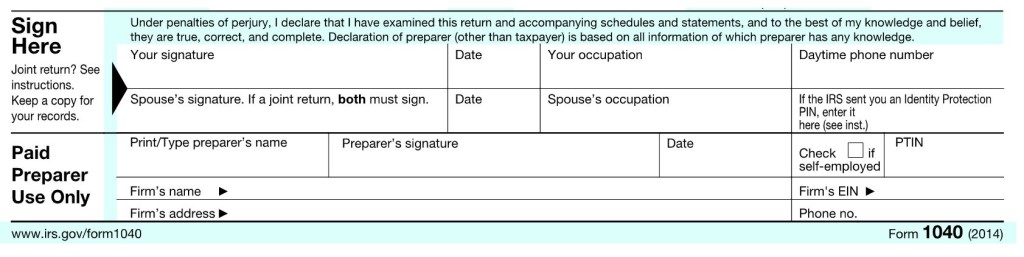

Signature and Responsibility

One last item that I think it is critical for a taxpayer to know and understand is that having a tax preparer does not alleviate you from the responsibility of what is entered on the tax return. See the perjury statement just above your signature!

So when I point this out to my clients, I am often asked, “then why should I pay someone to prepare my returns if I am still fully responsible?” This is a very logical and fiscally responsible question, especially if your tax preparation fees are high. Yes, high, is a subjective term. I did this on purpose because more than just the price of the return needs to be considered when determining the value of your tax preparer. In fact, the IRS has prepared YouTube videos and Podcasts exclusively on this topic, so I am not going to cover them all again here.

What I will stress is that the responsibility of a tax preparer is to interview you and review your tax documents thoroughly to understand your taxable situation as described in the above information. Then, he or she must accurately reflect that information, and be able to explain that information to you, as their client, until you can confidently sign as the taxpayer!

Professional tax preparers are registered with the IRS, the State Board of Accountancy or State Bar Association. They undergo rigorous testing and comply with continuing education requirements to stay abreast of current tax law and strategies. If they are reported or caught preparing returns unlawfully or even unethically, there are separate preparer penalties depending on the extent of the infraction. If you prepare yourself, or use an unregistered tax preparer, all the penalties and interest for errors are your responsibility regardless of whether the error was an honest mistake or fraud.

For a student or first job taxpayer, this risk is probably negligible or minimal, so the fee should also be (see https://www.irs.gov/uac/Free-File:-Do-Your-Federal-Taxes-for-Free). For taxpayers with more complicated returns, the risk is significantly higher, and the amount of time and professional knowledge and skill to prepare the return also increases.

This post should give you a good overview of the 1040 form itself. In future posts I will be covering each of the 1040 schedules in more depth. However, if this post didn’t answer all of your questions or if you have questions unrelated to the 1040 please feel free to contact me using the information in the footer of this page! You may also schedule a free consultation to discuss and ask questions specific to your tax situation. I look forward to hearing from you.

Trudy Hetzel is a licensed Enrolled Agent. She has owned and operated her business in Surprise, Arizona for 15 years and has over 20 years of accounting, bookkeeping and tax preparation experience. She’s a married mom with two awesome kids and three awesome dogs. Trudy loves helping people with their tax, accounting, and bookkeeping needs. Give her a call today!

Trudy Hetzel is a licensed Enrolled Agent. She has owned and operated her business in Surprise, Arizona for 15 years and has over 20 years of accounting, bookkeeping and tax preparation experience. She’s a married mom with two awesome kids and three awesome dogs. Trudy loves helping people with their tax, accounting, and bookkeeping needs. Give her a call today!

Leave a Reply Cancel reply

You must be logged in to post a comment.

-

About

Trudy's Taxes & Bookkeeping LLC provides individual and small business tax preparation, payroll, accounting, and consulting services to Surprise, AZ and surrounding cities of Sun City, Glendale, Peoria, Avondale, and Buckeye. Voted Best of Surprise, 2023.Privacy Policy and Terms of Service

Licenses and Certifications

Trust Seal

Share On